Of course, you want to file when you recognize the mistake.

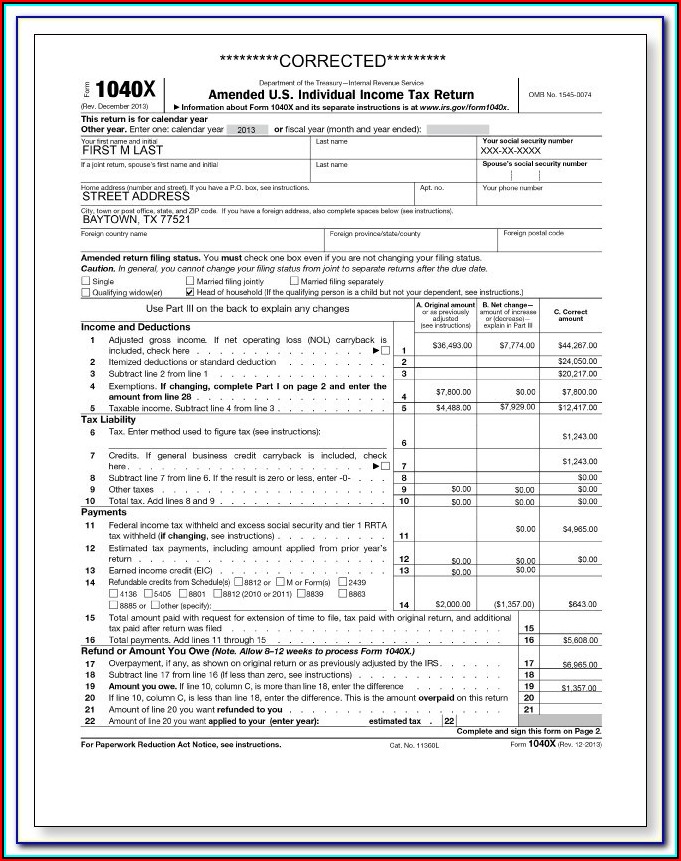

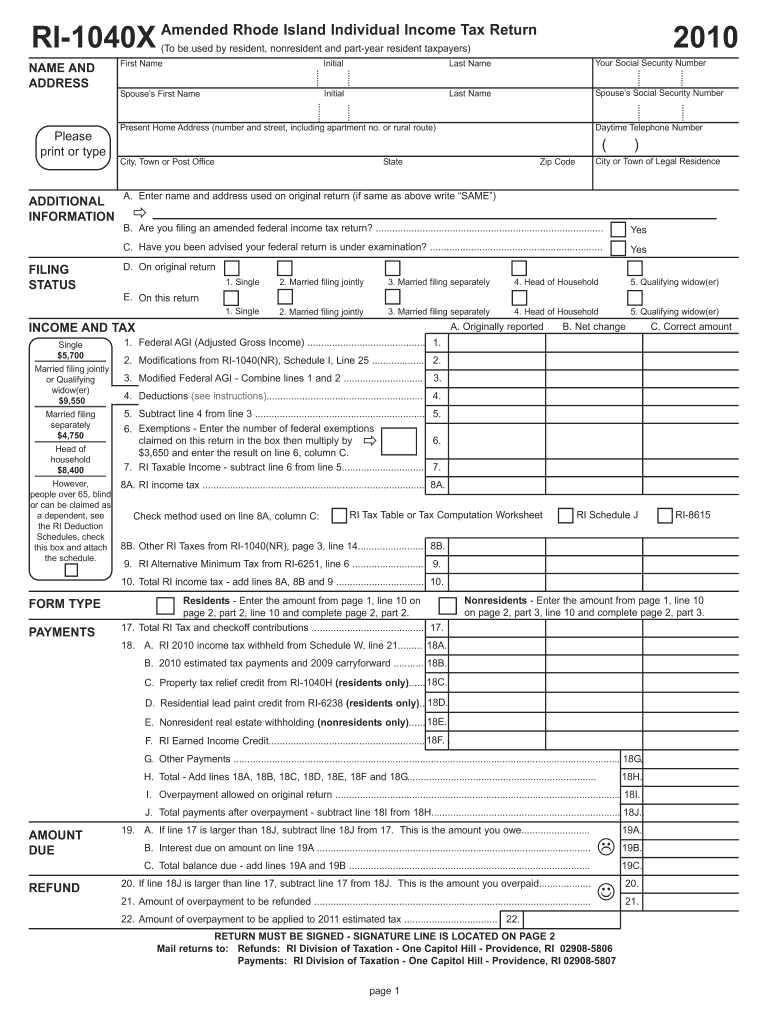

The IRS will expect you to include any forms or schedules with Form 1040-X that impact the changes. If you’ve made an error on more than one year’s worth of returns, each year needs its own 1040-X paperwork. If you file it before the form with the error is processed with the IRS, they could get confused about which one has the errors and which one is correct. You should not file the 1040X yet if they haven’t processed your current form already. Typically, the IRS will fix that kind of mistake on their own and send you a letter with the updated information for your records.įorm 1040-X allows you to file this form and show the IRS your changes to your tax return and the correct tax amount. There are some important things to know about filing Form 1040-X.Īgain, don’t choose to file this form if you’ve made a simple math error. You should not use this form for simple mathematical errors. This would include information that was left off by mistake or incorrect information was filed. You should use this form for mistakes in the filing where it changes the outcome of your tax filing. If you recognized you have made an error in your tax filing or you’ve left something off that changes the status of your return, you would use Form 1040-X to inform the IRS of the error and fix it. It’s for this reason the IRS has Form 1040-X. This might surprise you, but even the IRS understands that tax filers make mistakes on occasion. Read on to learn all you need to know about IRS Form 1040-X. Whether it means a bigger return or it means you owe, if you recognize an error made while filing taxes, you need to use Form 1040-X to inform the IRS of the error. Other times, it means you owe the IRS more.Įxperienced tax attorneys can help you with when you should complete IRS Form 1040X. Sometimes the error ends up in your favor which can mean a bigger tax refund.

Yet, it’s still surprising the number of people who have errors on their taxes that are found after completing their filing. For this particular year that isn’t that surprising because of the sweeping changes made by Congress in 2017. You might be surprised to learn that up to 80% of those filing taxes in 2018 made some kind of mistake on their taxes.

0 kommentar(er)

0 kommentar(er)